The Definitive Guide to Transaction Advisory Services

Wiki Article

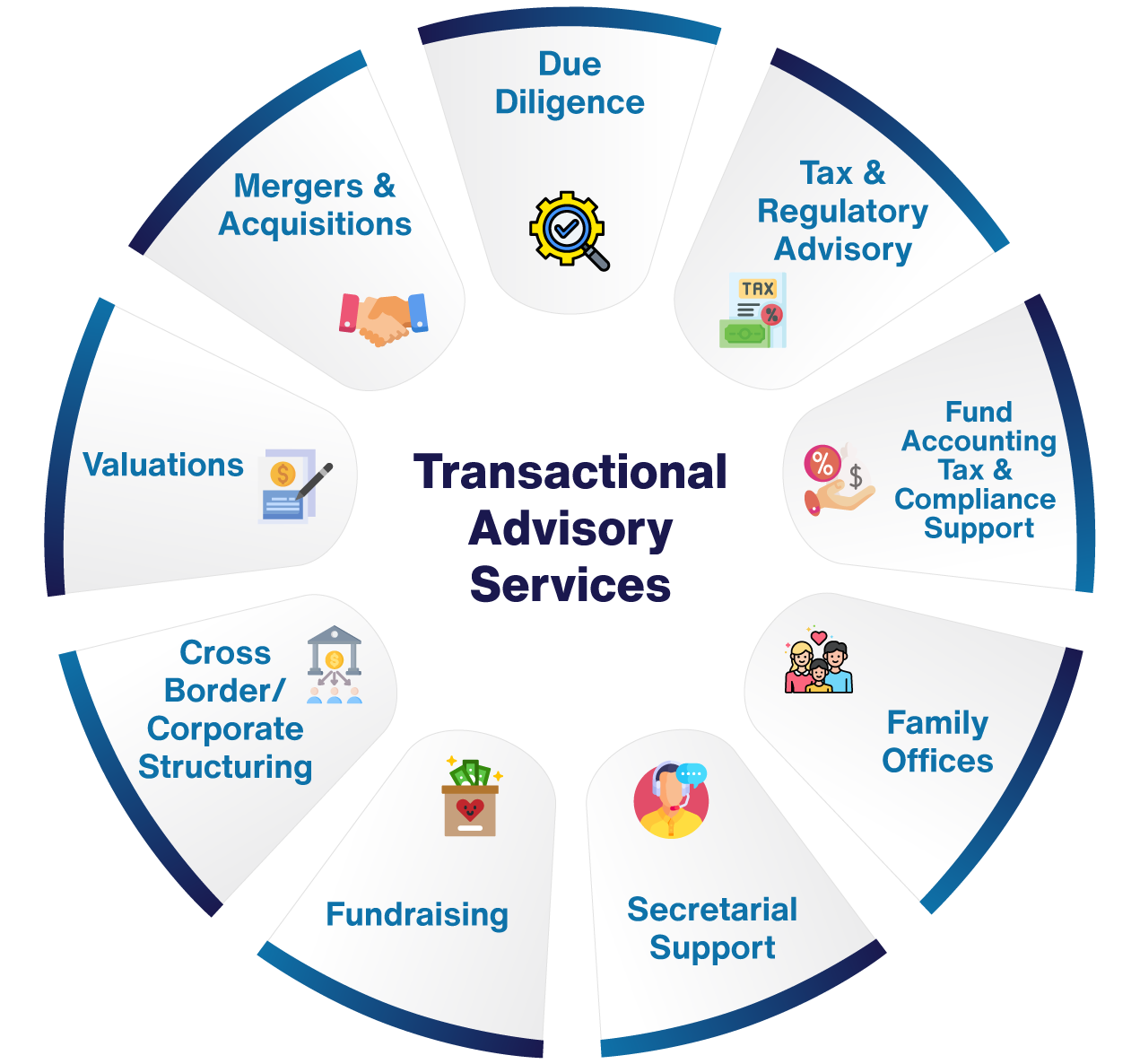

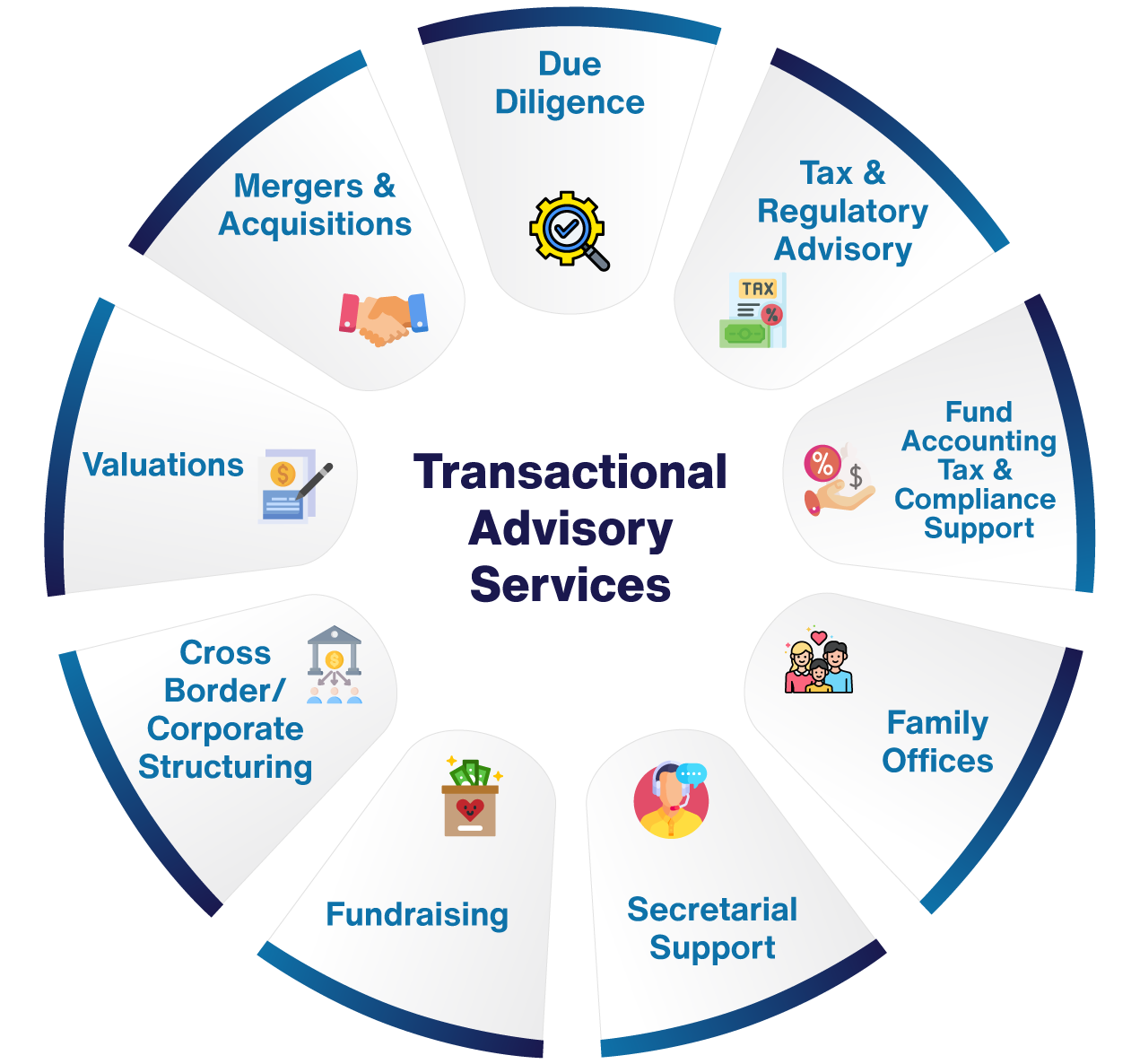

The 8-Second Trick For Transaction Advisory Services

Table of ContentsAn Unbiased View of Transaction Advisory ServicesTransaction Advisory Services Fundamentals Explained9 Easy Facts About Transaction Advisory Services ExplainedSome Known Factual Statements About Transaction Advisory Services Unknown Facts About Transaction Advisory Services

And number that Big 4 companies could supply less complicated pathways right into higher-paying work in finance, consulting, and associated areas. I could take place, but you obtain the concept. The factor is, everybody arguments the advantages of these jobs, but there's still a great deal of confusion over what "Purchase Providers" indicates.

By comparison, Huge 4 TS teams: Work with (e.g., when a prospective purchaser is performing due persistance, or when an offer is shutting and the buyer requires to incorporate the company and re-value the vendor's Equilibrium Sheet). Are with fees that are not connected to the deal shutting successfully. Make fees per engagement someplace in the, which is less than what financial investment banks gain even on "little offers" (but the collection likelihood is likewise a lot higher).

Unlike these three teams, the and teams are much closer to financial investment banking. The Corporate Money group at the majority of Big 4 companies is an inner investment bank that performs whole M&An offers from beginning to finish. The experience is much more relevant for IB/PE roles, however these CF groups additionally have a tendency to function on smaller deals than the FDD groups.

The Basic Principles Of Transaction Advisory Services

The meeting inquiries are very comparable to investment banking meeting inquiries, yet they'll concentrate much more on audit and assessment and much less on topics like LBO modeling. Anticipate questions regarding what the Modification in Working Funding methods, EBIT vs. EBITDA vs. Take-home pay, and "accountant just" subjects like trial equilibriums and just how to stroll through occasions using debits and credits rather than financial declaration adjustments.

that show just how both metrics have actually altered based upon products, networks, and customers. to judge the accuracy of management's previous forecasts., including aging, inventory by item, typical degrees, and stipulations. to establish whether they're entirely imaginary or somewhat credible. Professionals in the TS/ FDD groups might additionally interview monitoring about everything above, and they'll create an in-depth report with their searchings for at the end of the procedure.

The pecking order in Purchase Providers varies a bit from the ones in financial investment financial (Transaction Advisory Services) and exclusive equity professions, and the basic shape looks like this: The entry-level duty, where you do a great deal of data and economic analysis (2 years for a promo from here). The following level up; comparable job, however you obtain the even more intriguing bits (3 years for a promo).

Specifically, it's difficult to get advertised past the Supervisor level due to the fact that few individuals leave the task at that phase, and you need to begin revealing proof of your capability to create earnings to advancement. Let's begin with the hours and lifestyle given that those are less complicated to explain:. There are periodic late nights and weekend break job, however nothing like the agitated nature of financial investment financial.

Some Known Details About Transaction Advisory Services

There are cost-of-living changes, so expect reduced payment if you're in a more affordable location outside major monetary. For all positions other than Companion, the base pay makes up the mass of the total compensation; the year-end perk could be a max of 30% of your base salary. Commonly, the very best way to enhance your revenues is to change to a different company and work out for a greater income and bonus.You might enter corporate development, yet financial investment financial gets harder at this stage since you'll be over-qualified for Expert roles. Business financing is still an option. At this stage, you must just stay and make a run for a Partner-level duty. If you wish to leave, perhaps relocate to a customer and execute their evaluations and due diligence in-house (Transaction Advisory Services).

The main trouble is that due to the fact that: You generally need to join one more Huge 4 team, such as audit, and work there for a couple of years and afterwards relocate into TS, work there for a few years and after that move into IB. And there's still no warranty of winning this IB role because it depends on your region, clients, and the hiring market at the time.

3 Easy Facts About Transaction Advisory Services Shown

Longer-term, there is likewise some threat of and due to the fact that assessing a firm's historical financial information is not specifically rocket science. Yes, human beings will constantly require to be entailed, however with more innovative modern technology, lower headcounts click now can possibly support client engagements. That stated, the Transaction Providers team defeats audit in regards to pay, work, and leave chances.If you liked this post, you could be curious about analysis. (Transaction Advisory Services)

The Main Principles Of Transaction Advisory Services

see here For Colorado & Illinois Candidates: We are happy to supply qualified staff a durable advantages plan. Qualification and payment needs for some of these advantages differ based on the number of hours team work per week.A Pension plan is also available for qualified management and paraprofessional staff. A discretionary incentive strategy is readily available for qualified staff. Plante Moran also supplies Interns and Specialists the choice to choose medical insurance under our contingent staff medical strategy as of the 1st of the month complying with 60 days of work along with limited paid time ill time.

Think of it as being the economic doctor for companies going through major surgical procedure. They look at the company's health and wellness, determine the dangers, and aid make certain the entire point goes smoothly. It's not simply concerning grinding numbers; it's additionally regarding recognizing the organization, the marketplace, and the people involved.

Report this wiki page